Financially troubled KTM’s debts rose to nearly 2.2 billion euros, while 23 investors have offered enough money to finance the company’s proposed plan for restructuring, the latest reports from the bankruptcy proceedings indicated.

Claims against KTM AG now total 2,185,344,613.84 Euros, or approximately $2.298 billion, according to a report released today by AKV EUROPA/Alpine Creditors Association, the agency monitoring the court proceedings.

That figure is expected to rise, the agency’s report said.

The company is expected to continue to operate, the agency said, as only an ongoing operation will attract the investment needed. There are sufficient funds to continue operations into the eighth week of 2025, the report stated. Potential investors include both financial and strategic investors, the report said. (Strategic investors bring industry-specific expertise, resources and connections to a company as well as money.) However, the report does not name any of the potential investors.

The money on the table from those investors would allow KTM to proceed with a restructing plan that involves paying off its outstanding debts at 30 percent of their face value, the Pierer Mobility Group said in a statement released yesterday. The 30 percent figure is the legal minimum repayment offer.

However, the overall debt figure is expected to rise, the AKV report said, and an analysis is ongoing into the financial relationships between the various entities under the broad KTM banner. A meeting is scheduled for Feb. 25 to determine whether sufficient investment has been reached, the report states.

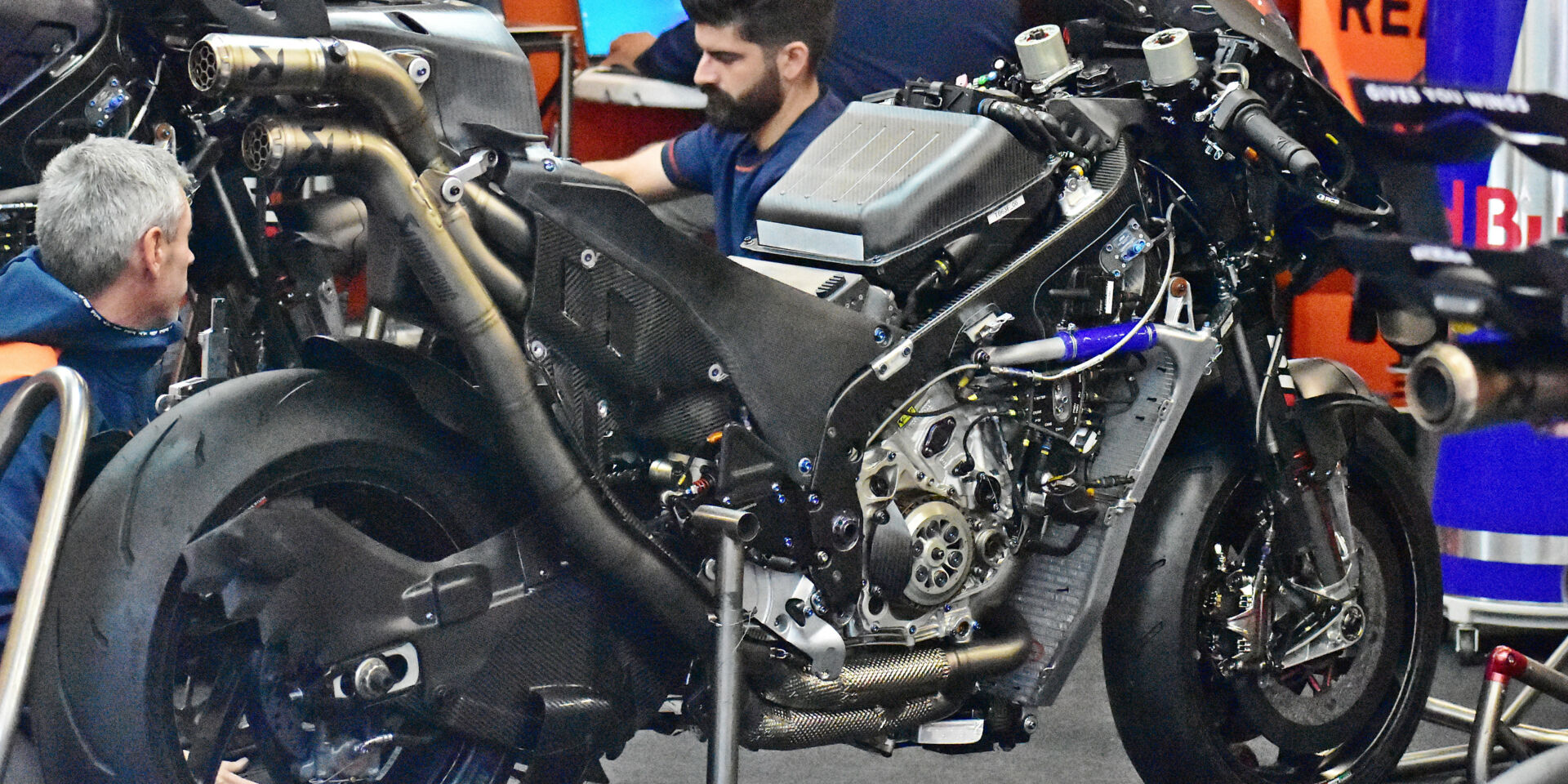

Unlike the previous report by AKV, there is no mention of withdrawing from Grand Prix motorcycle road racing. Longtime KTM CEO Stefan Pierer has stepped down from his post, and production is at a standstill as the company works to reduce its inventory of unsold motorcycles. But KTM’s racing department says it is building racebikes for the 2025 MotoGP season and will participate in the 2025 series.

The full statement from AKV follows:

As is known, on November 29, 2024, restructuring proceedings with self-administration were opened for the assets of KTM AG and its two subsidiaries KTM Forschungs & Entwicklungs GmbH and KTM Components GmbH.

Today the general examination hearings took place at the Regional Court of Ried im Innkreis.

Following the conclusion of the hearing in the KTM AG proceedings, the Alpine Creditors Association (AKV) announces:

Generally:

The current status of the claims filed will be announced at the examination hearing. In addition, the insolvency administrator and the insolvent debtor must make a statement about all claims filed to date, which must either be acknowledged or disputed.

The individual procedures are as follows

KTM AG

claims filings

To date, 3,534 claims have been filed , namely 2,347 claims from employees and 1,187 claims from other insolvency creditors.

The registered claim volume is:

Claims filed by other insolvency creditors EUR 2,172,626,058.36

Claims filed by employees: EUR 12,718,555.48

Total: EUR 2,185,344,613.84

To date, claims amounting to EUR 1,665,985,681.24 have been recognised.

Numerous subsequent claims are to be expected. The claims do not yet include termination claims from employees who have been terminated or left the company, and claims are still being submitted to the court on an ongoing basis, which will be dealt with separately in another special hearing. It is therefore to be expected that the claims filed in the proceedings will increase.

For the time being, the “intercompany” claims are disputed under the aspects of equity replacement and possible challenges. These issues are being examined in detail with the assistance of experts, after there has been a considerable increase in intra-group receivables and offsetting since January 1, 2023 to finance the ongoing (loss-making) business and the high liquidity requirement. The restructuring administrator is therefore currently busy analyzing the intra-group financing.

In particular, claims for damages filed (conditionally) by creditors in the event of non-entry into current contracts are also provisionally disputed. Since the production plans are currently being revised, there are often no statements from the restructuring administrator or the debtor company regarding contract entry or contract withdrawal. In the event of contract withdrawal, the claims for damages filed would become effective.

The claims filed by creditors who have asserted rights of separation on the grounds of retention of title have also been provisionally disputed. The volume of claims in question is approximately EUR 200 million. In this regard, the restructuring administrator is examining whether these rights of separation or retention of title have been legally agreed.

employee

The number of employees has decreased since the insolvency proceedings began. Of the original 2,477 employees, 1,991 are currently still actively employed , following several waves of layoffs and resignations.

In addition, 100 temporary workers have been laid off since the insolvency proceedings began.

Furthermore, three management contracts were terminated with the consent of the restructuring administrator.

Continuation / Liquidity

As is well known, production is currently at a standstill. The “continuation”, especially the continued payment of wages to the largely laid-off workforce on short-time work, is therefore financed through existing assets. In order to secure liquidity, it was therefore necessary to reverse the real estate transaction of PIERER IMMOREAL GmbH. Further inflows will come via the sales subsidiaries. At the level of the sales subsidiaries in particular, efforts are being made to reach a final agreement with the institutions providing financing there in order to secure liquidity in the longer term.

According to a validated continuation financial plan, the insolvency estate should have sufficient liquid funds until week 08/2025. It is hoped that an agreement can be reached with potential investors by then, because according to the current status of the proceedings, financing the restructuring plan quotas only seems plausible through an investor.

investors

Despite the production stoppage, the company will continue to operate, as only a “living” KTM Group will allow investors to enter the business.

At the same time, KTM’s parent company PIERER Mobility AG commissioned Citygroup Global Markets Europe AG (“Citibank”) to find an investor solution. This process is underway and a total of 23 potential investors are participating. These are said to be both strategic investors and financial investors.

Further checks

Numerous reviews that have been initiated have not yet been completed due to the scale of the procedures.

This concerns the appropriateness assessment of a restructuring plan, the examination of the causes of insolvency and the decline in assets as well as possible liabilities or challenges. In addition, an estimate of the movable assets was commissioned.

The restructuring plan continues to provide for the statutory minimum offer of 30%, payable within 2 years.

The redevelopment plan meeting is scheduled for Tuesday, February 25, 2025, and it remains to be seen whether a concrete offer can be negotiated by then.

KTM Components GmbH

So far, 739 claims have been filed in this procedure , 478 of which are from employees.

Insolvency claims amounting to EUR 80,971,072.08 were filed , of which claims amounting to EUR 48,886,627.97 were initially recognised.

The disputed claims amounting to approximately EUR 32 million are in the same situation as those of KTM AG. The disputes therefore concern the “intercompany” claims amounting to EUR 21.9 million, possible claims for damages as a result of non-entry into contracts and estimates by the tax office and the ÖGK.

In this procedure, too, numerous subsequent claims are to be expected; in particular, the claims for termination of employment by employees are still missing.

When the insolvency proceedings began, the company employed 478 people . During the ongoing proceedings, 97 employees were dismissed or resigned.

The majority of employees have been laid off as there is currently no production. The financial plan is being adhered to and liquidity and ” continuation ” are being coordinated with KTM AG, which is the main customer providing the liquidity.

In this procedure, too, the restructuring plan meeting is scheduled for February 25, 2025. The implementation of a restructuring plan will depend on an investor entering the KTM Group.

The above figures refer to documents made available to us yesterday and may change slightly in today’s session, as this does not take place until 1:00 p.m.

KTM Forschungs & Entwicklungs GmbH

So far, 1,162 claims have been filed in this procedure , 772 of which are from employees.

Insolvency claims amounting to EUR 111,935,523.75 were filed , of which claims amounting to EUR 41,409,918.79 were initially recognised.

The disputed claims amounting to approximately EUR 70.5 million are in the same situation as those of KTM AG and KTM Components GmbH (“intercompany” claims, claims for damages, etc.).

Subsequent claims are also to be expected in this procedure.

The company currently employs 550 people . At the beginning of January 2025, there were a total of 146 layoffs.

In this procedure too, the continuation depends on the provision of liquidity via KTM AG.

The restructuring plan meeting is also scheduled for February 25, 2025 and the fulfillment of a restructuring plan is dependent on an investor entering the KTM Group.